Happy Birthday, Exchange Traded Funds! It’s 20 years today since the launch of the first ETF in Australia. ETFs are simply managed funds that are bought and sold on the ASX (Australian Securities Exchange). There are no entry or exit fees, or buy/sell spreads (which is where you pay more for something than it is sold for); only costs are brokerage, which can be just a few dollars each trade.

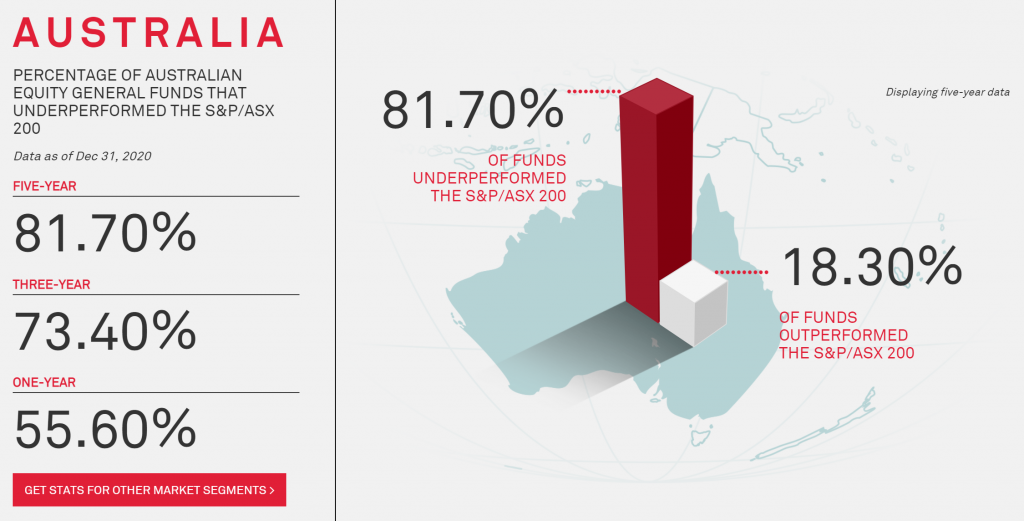

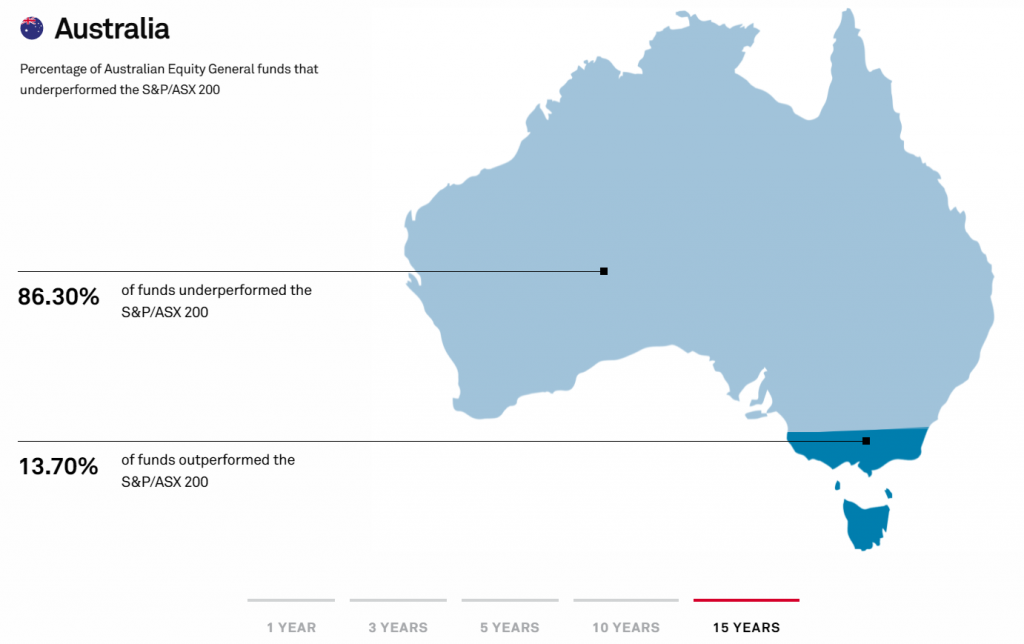

We like passively managed ETFs here at Periapt Advisory, since the research consistently shows that these are likely to outperform actively managed funds. Active fund managers try to outperform their benchmark index* by picking sectors and securities they believe will outperform in the future, but their long-term performance is not great: 4 out of 5 actively-managed funds fail to consistently outperform the S&P/ASX 200 index (the 200 biggest companies on the Australian Securities Exchange).

The further back you go, the more this underperformance increases.

We have an evidence-based approach to investing, consisting of well-established observations from financial science. An investment in this first Australian ETF tracking the return of the top 200 companies on the ASX would have delivered annualised returns of 8.23% p.a. over the last 20 years, which is pretty close to the index’s return of 8.54% (Any index fund will usually lag its benchmark index by the margin of its fees. It Is therefore critical to keep these fees as low as possible.)

Past performance is no guarantee of future performance, but it’s the most adequate guide to use. Exposure to growth assets such as Australian shares has delivered consistently high returns for sustained periods. There are other well-researched approaches we use as part of our overall investing philosophy. Talk to us today if you are interested in learning how you can best grow your wealth over time.

*An index is an indicator or measure of something, and in finance, it typically refers to a statistical measure of change in a securities market. Stock market indices consist of a hypothetical portfolio of shares representing a particular market or a segment of it. (You cannot invest directly in an index.) It is computed from the prices of selected stocks and helps investors compare current price levels with past prices to calculate market performance.